In the recent release of the Medicare and Medicaid CY 2024 Home Health Prospective Payment System Rate Final Rule, CMS finalized the PDGM permanent behavioral adjustment. Originally proposed as a 5.779% cut, CMS decided to phase in the reduction, with only half of the rate being adjusted in CY 24. This mirrors the approach taken in the previous year, where the proposed permanent behavioral cut was also halved.

Taking into account the market basket increase of 3.3%, tempered by the productivity adjustment of 0.3%, along with additional allowances for outlier payments, CMS projects a modest 0.8% increase (equivalent to $140 million) in home health agency (HHA) revenues for CY 2024 compared to CY 2023. This is a notable departure from the proposed rule, which suggested a 2.2% decrease amounting to $375 million.

In the final rule, CMS addressed the ongoing pause on the $3.49 billion in temporary cuts from behavioral adjustments spanning CY 2020 to CY 2022, that is yet to be reclaimed. The uncertainty looms larger with the continuation of fifty percent reductions in CY 2023 and now CY 2024, bringing the estimated total to approximately $4.59 billion. CMS' hesitation may be linked to the outcome of the federal lawsuit (NAHC vs Becerra), where industry stakeholders challenge the validity of the CMS calculations for these behavioral changes.

The potential implementation of these cuts could prove detrimental to the home health industry, especially as Medicare Advantage (MA) penetration continues to rise. Traditionally, Medicare Fee-for-Service (FFS) payments have subsidized MA plans, often falling below the cost of providing care. CMS, in its rule, asserted that it does not account for subsidizing.

In response to calls for considering the overall financial condition of HHAs, CMS remains steadfast, stating, "We have never endorsed the view that Medicare funds should be used to subsidize reimbursement rates from other payers—a policy that would be inconsistent with our obligation to be responsible stewards of the Medicare Trust Funds…"

This perspective appears shortsighted when considering the crucial role home health plays in allowing patients to age in place. CMS acknowledges the savings expected from the Home Health Value-Based Purchasing (HHVBP) program, estimating a $3.38 billion reduction in unnecessary hospitalizations and SNF usage between CY 2024 and CY 2027.

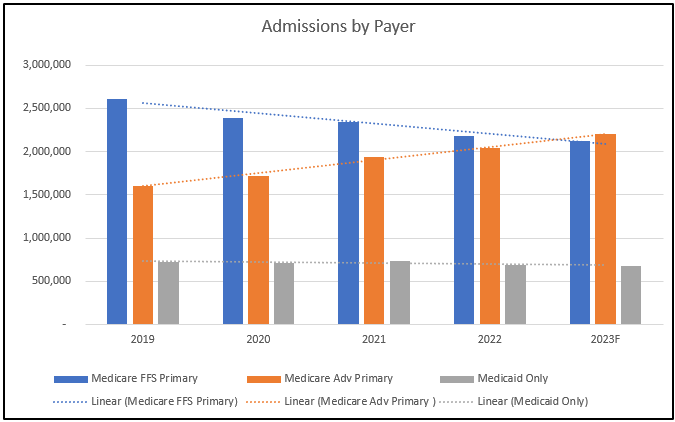

Nationally, MA plan enrollments are outpacing traditional Medicare FFS, a trend mirrored in SHP payer information for Starts of Care (SOC) between 2019 and 2023 (based on agencies with assessments across all 5 years).

Notably, in the first half of CY 2023, Medicare Advantage SOCs or admissions surpassed those of Medicare FFS patients for the first time in the last five years.

It becomes imperative for CMS and Congress to adopt a broader perspective beyond Medicare FFS traditional payments. A comprehensive solution is needed to level the reimbursement playing field, ensuring that home health agencies receive fair compensation for their role in enabling patients to remain in their homes.